Tips and Tricks for Avoiding ATM Fees Abroad

Written by Kali Todd

Budget Travel Guides & Tips

August 30, 2023

This post may contain affiliate links, which means I’ll receive a commission if you purchase through my link, at no extra cost to you.

Traveling abroad can be exciting, bringing about new experiences and opportunities, but it often comes with hidden costs such as ATM fees. While ATMs offer convenience and accessibility, travelers may be faced with hefty fees and mark-ups. In this article, I will delve into how you can significantly reduce and even eliminate these expenses overseas.

What are mark-up fees on foreign ATM withdrawals?

When withdrawing funds from a foreign ATM, it’s almost guaranteed that you will see additional charges either in mark-ups or a flat fee for using the machine. The markup is usually seen as a percentage of the amount you are attempting to withdraw, which is also called a dynamic currency conversion (DCC).

Dynamic currency conversion is an ATM service that converts withdrawal amounts into the customer’s home currency. But of course, when withdrawing money from an American bank account in a country such as Germany, the funds have to be converted anyway. DCC is a way for ATMs to make a big cut from unsuspecting tourists. Machines can have both a percent fee (DCC) and a flat fee for transactions, making withdrawals add up quickly!

What are transaction fees on foreign ATM withdrawals?

Transaction fees are typically a flat rate for using the machine for a cash withdrawal. No matter how much you withdraw, the fee for using the machine will stay the same. It is usually a few dollars for every transaction.

How can I avoid international ATM markup fees?

The great thing is this tip has worked on almost every ATM I have used internationally. After selecting the withdrawal amount, it’s likely that you will come across a screen where you’ll see a markup added to the withdrawal, which is absolutely ridiculous. The trick? Select ‘Decline Conversion’. Funds will then be dispensed and you will not be charged the markup. Your home bank will use the interbank rate, which falls closely in line with the currency exchange rates. Scroll to the end of this article to see an example of this. Declining conversions will be the cheapest option. But what about the transaction fee?

How can I avoid ATM transaction fees?

You’re going to be hard-pressed to find an international ATM that charges no transaction fee. So the trick here is to have the right card in your wallet. Charles Schwab offers a fee-free Investor Checking Account that will reimburse all transaction fees from ATM cash withdrawals, with no limits on the number of reimbursements each year. That 3.95 Euro transaction fee, for example, will be reimbursed in full at the end of the month when the transaction occurred. An ATM withdrawal with a 3.95 Euro transaction fee that occurs on September 18 will be reimbursed on September 30, for example.

What if the ATM will not let me decline the ATM markup?

The ATM markup, if accepted, will not be reimbursed using the Charles Schwab card. Only the transaction fee is reimbursable by Charles Schwab. Because of this, if the ATM will not let you decline the conversion, you will have to find another ATM to avoid the fee. Typically, your best bet is to use an ATM within a credit union or bank, rather than ATMs that are conveniently placed in big tourist areas in cities and airports.

Will my bank charge additional fees on foreign ATM withdrawals?

Yes, if you have to use a typical bank card such as Chase, you will also be charged:

- $5 Foreign ATM Fee

- 3% Foreign Transaction Fee

These Chase fees are on top of the fees the specific ATM charges. An unsuspecting tourist wanting to withdraw only 20 Euros would be left paying 35.65 USD after paying the transaction fee, markup, Chase ATM fee, and Chase foreign transaction fee. If this tourist had declined the conversion and used their Schwab Card, their account would have reflected a charge close to 24.38 USD, 32% less.

Should I order currency at my home bank before I travel?

No! With so many countries taking advantage of the convenience of card payments, you might not need cash at all on your trip. With the Schwab Card, it is not only easy to stop at an ATM once you reach your destination, but you will likely receive the best rate if you decline any dynamic currency conversions the ATM offers compared to ordering currency beforehand. Home banks typically charge a flat fee on top of mediocre exchange rates when ordering ahead of your trip. Why bother when Schwab will reimburse your ATM fees abroad?

Who can get a Charles Schwab Investor Checking Account? What other benefits are there? Where can I sign up?

Any US resident is eligible for the Schwab Bank Investor Checking account. This account has unlimited ATM fee rebates, $0 account fees, no balance minimums, and no foreign transaction fees. You can sign up easily here. This is a checking account, not a credit card. To use foreign ATMs you must have funds available in the account. Signing up for an account does not affect your credit in any way.

Tips

Utilize the Charles Schwab Investor debit card for ATM withdrawals during travel but make sure to switch to a credit card with no foreign transaction fees when you don’t need to use cash. Using a credit card not only protects you from unauthorized purchases but also can earn you points toward more travel. Not sure how? Check out my article about the Capital One Venture X, one of the most powerful travel rewards credit cards out here.

Because some foreign ATMs can force you to use their conversion, stick to bank ATMs. This means not utilizing that perfectly placed ATM next to a famous outdoor market. A simple Google Maps search can show you the closest bank. In Munich, Germany the famous Viktualienmarkt (Victuals Market) had a conveniently placed ATM that would not allow us to decline the conversion. We canceled the transaction and later in the day, we stopped at PostBank which gave us much better rates.

Examples

Here you will see that the ATM is asking if the withdrawal should be charged in Euros or in your home currency. Always select the local currency. (This goes for credit card purchases as well.) You should select Charge In Euro in this example.

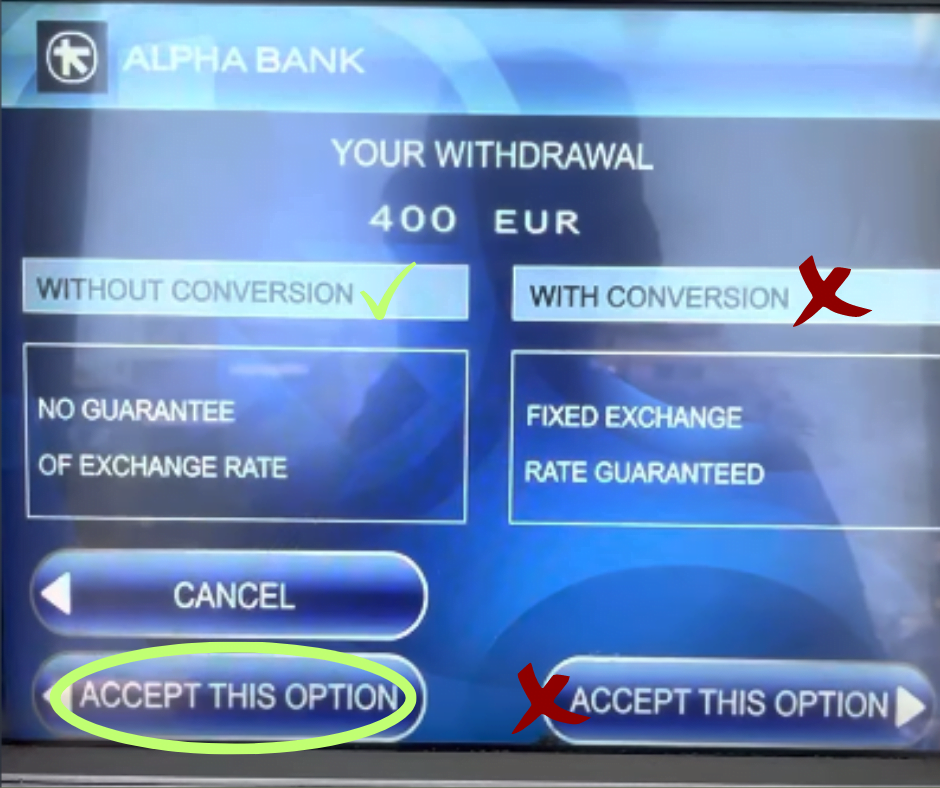

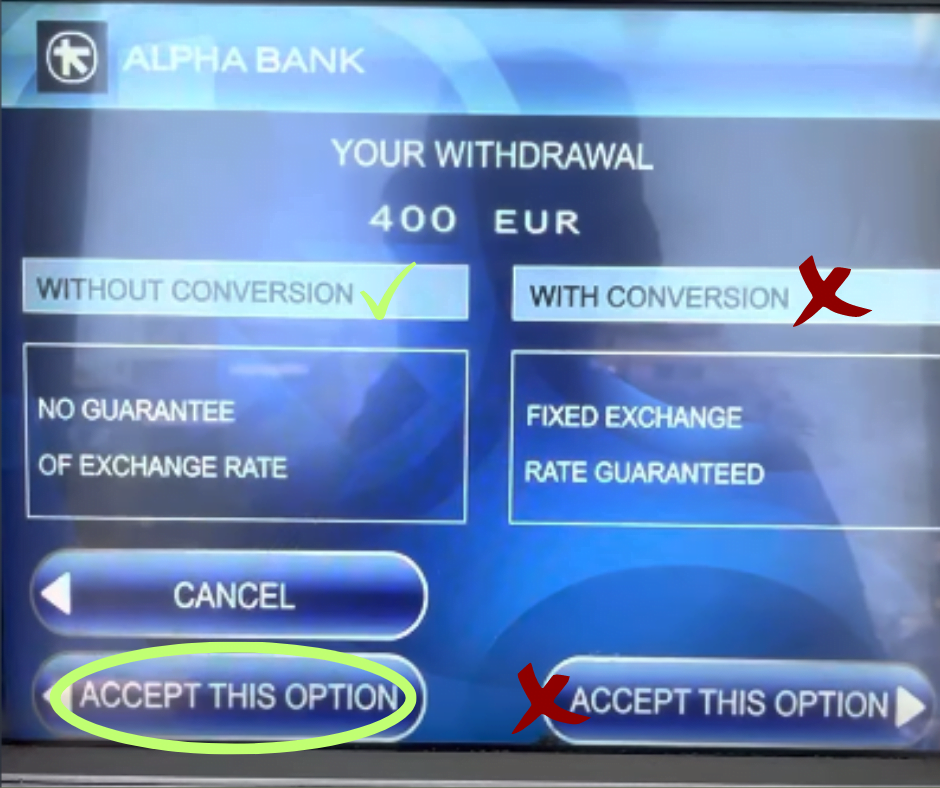

In this example, the ATM is once again trying to convince you to use the ATM conversion and tempting you with a guaranteed rate, making you think that you could be charged something crazy for not using their conversion. Never select ‘with conversion’. Here we would select the option on the left, Without Conversion.

Here is a different ATM company, one that is pretty popular across Europe. We can see on this screen that along with a 3.95 Euro Transaction Fee, Euronet is attempting to charge us a 13% markup. Select Decline Conversion! By doing this, you will only be charged the 3.95 Euro Transaction Fee (reimbursable through Charles Schwab) and not the 13% markup.

Unleash the Benefits of a Travel Credit Card: Capital One Venture X

Having the right credit card in your wallet can make all the difference. Capital One’s Venture X only recently came out but is already a top competitor compared to seasoned travel rewards credit cards.

Car Rentals: Stop Paying Young Driver Fees

Young driver fees can make a weekend getaway unaffordable. But did you know there is a way to bypass these fees entirely?

Error Fares: How I Scored My First Flight Deal

An error fare is like winning the lottery. It’s when flight pricing algorithms fall out of line or someone simply misses a digit when repricing a route.

Currently on vacation right now so this is perfect timing! Thanks for such great tips

Looking to travel to Europe soon, so this is super helpful! Thank you!

Thank you for sharing. I have not seen the tip about not accepting the conversion before. I haven’t noticed this on my travels to Central America but will know for future foreign travel.

I bank with Fidelity and they also reimburse atm fees.

I need to try this on my next trip!

Thank you for sharing this 🙂

Super helpful. Will keep in mind for my next trip, Thank you.

Hiii! Great tips, thanks for sharing! 😊 Here’s another travel tip to save on atm fees: I recommend “ATM Fee Saver” – the travel app helps you find ATMs with no or low fees for withdrawing money. It also locates Forex and exchange spots. I use it on every trip and it saved me tones of money!

Thank you for the extra tip!